Editorial Mention: The message regarding the blog post is founded on the brand new author’s viewpoints and guidance alone. It might not have been previewed, accredited otherwise endorsed by the any of all of our system partners.

The list of preferred ways to use your own loan include money a large buy, coating an emergency costs and you will merging financial obligation. Personal loans, which can be generally unsecured, is actually paid inside the monthly obligations with focus. Most lenders will appear at the creditworthiness or other factors to influence their rate of interest. You should invariably assess the purpose of financing to choose if you will want to acquire and have the power to generate payments.

- What is the aim of a loan? six aspects of unsecured loans

- 4 reasons to choose a personal financing over the other type of obligations

- Ought i get your own loan? cuatro inquiries to inquire about

What is the aim of that loan? 6 reasons for having signature loans

- Consolidate loans to settle expense

- Coverage unplanned crisis costs

- Make needed domestic repairs

- Fund funeral service expenses

- Let defense swinging will cost you

- Generate a giant pick

1. Combine personal debt to pay off debts

Merging loans is one major reason to help you borrow your own mortgage. This method produces feel if you can safer good low interest. For many who spend their almost every other bills to the funds from good consumer loan, it is possible to only have you to fixed payment, and you will probably manage to spend less on appeal.

The typical Apr to the a good twenty-four-month personal loan is 9.46% as of – the new investigation offered by the fresh Government Reserve – since the mediocre rate of interest towards all the bank card levels is %.

2. Cover unplanned emergency expenditures

While it is better to generate an urgent situation financing to cover unanticipated expenditures, an urgent situation personal bank loan may help if you aren’t but cash to payday Hawkinsville GA really prepared.

Good 2019 LendingTree study from emergency discounts unearthed that just forty eight% out of People in the us could handle a $1,100000 disaster cost using merely the deals.

step 3. Generate expected home repairs

you might has actually a need a number of home updates, you might just envision a personal mortgage to possess crisis points impacting your health and cover.

4. Money funeral service expenses

When someone passes away from the comfort of about sufficient funds getting funeral service will cost you, it does place a life threatening monetary pressure on the enduring members of the family players.

The median price of a funeral with a viewing and burial inside 2019 is $eight,640, depending on the Federal Funeral service Administrators Relationship. Of a lot will not have sufficient stored to fund one prices all of the at the immediately after.

A funeral mortgage could well be a thought when you’re incapable of safeguards the expense of a funeral service. You may be capable of geting a funeral mortgage with less than perfect credit.

5. Help defense moving will set you back

Several other tip one of the mortgage objectives: layer moving can cost you. There are many different conditions where moving loans can make sense:

Work bring in another area are several other valid reason to go, you must look into cautiously in case your new income and value regarding life style makes it you’ll be able to to repay the loan.

Moving finance getting poor credit are you’ll, but they had typically come with higher interest rates. You ought to calculate if your new money will cover brand new additional moving expenses.

six. Create a giant pick

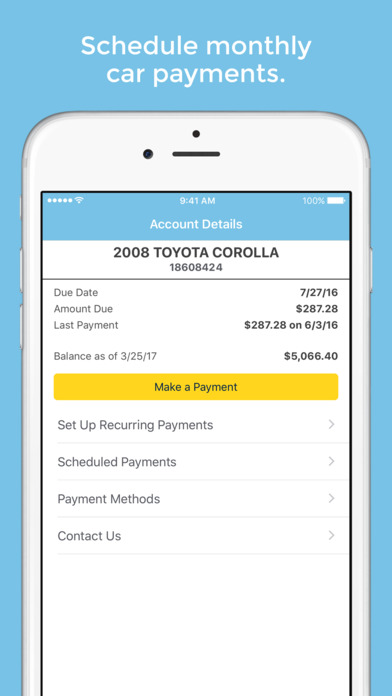

You could take out an individual loan to invest in an enormous purchase, but that does not mean you ought to borrow funds to find a good the newest activity system, platform place or auto. Certain high instructions are essential, like unexpectedly needing a unique big instrument.

As you are able to use your own financing to find a car or truck, automotive loans are typically preferable, since they will often have down rates of interest and simpler certification standards.

Concurrently, automotive loans need guarantee, and that means you you will clean out your car or truck for folks who fall behind into the repayments. It is advisable evaluate prices, particularly when you might be worried about risk.

While an individual loan would be a monetary lifeboat for the majority of items, it isn’t usually the best choice. It is vital to remember that there are even bad reasons why you should get your own mortgage. Meticulously believe your entire selection before you sign people loan plans.

(65) 6793 7805

(65) 6793 7805