Is Forex Trading Gambling? A Deep Dive into the Risks and Rewards

Forex trading and gambling are often compared due to their inherent risks and uncertainties. Both activities involve the potential for significant financial gain or loss, and many individuals find themselves drawn to the thrill of speculation. However, what differentiates forex trading from traditional forms of gambling like poker or slot machines? In this article, we will explore the nuances of forex trading, understand its mechanisms, and assess whether it should be categorized as a form of gambling. For those interested in venturing into forex trading, platforms such as is forex trading gambling Trading Platform PH can provide helpful resources and tools.

Understanding Forex Trading

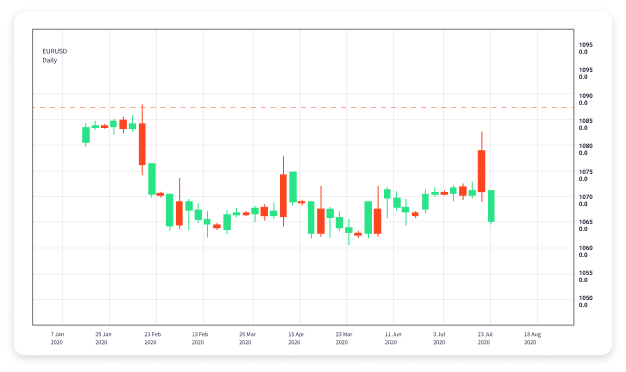

The foreign exchange market, or forex market, is the largest financial market in the world. It operates 24 hours a day, five days a week, and enables the exchange of currencies globally. Unlike other markets, forex trading does not deal with physical assets; instead, traders buy and sell currency pairs based on their expectations of price movement.

Forex trading is driven by various factors, including economic indicators, geopolitical events, and market sentiment. Traders analyze these elements using different methods, such as fundamental analysis and technical analysis, to make informed decisions. The aim is to capitalize on fluctuations in exchange rates, which can be influenced by interest rates, inflation, political stability, and other factors.

The Gambling Aspect of Forex Trading

While forex trading involves analysis and strategy, the potential for financial loss raises questions about whether it resembles gambling. In many ways, both activities rely on risk and uncertainty. In gambling, a player bets money on an outcome with an element of chance, such as the roll of dice or the turn of a card. Forex trading, although reliant on analysis, can also be seen as gambling when traders make decisions without sufficient knowledge or strategy.

Similarities Between Forex Trading and Gambling

1. **Risk of Loss**: Both forex traders and gamblers face the possibility of losing their entire investment. In forex, the market can be highly volatile, and sudden price shifts can wipe out positions in a matter of moments. Similarly, gamblers can lose substantial amounts of money in a short time, particularly in games with a high house edge.

2. **Emotional Decision Making**: Many traders and gamblers make decisions driven by emotion rather than logic. Fear, greed, and overconfidence can lead to impulsive trades or bets that deviate from one’s strategies or limits. In both cases, the psychological aspect plays a pivotal role in the success and failure of individuals.

3. **Leverage and Margin**: In forex trading, leverage allows traders to control larger positions with a smaller amount of capital. While this can amplify profits, it also increases the potential for significant losses. This leverage mirrors the betting mechanics in gambling, where individuals may wager more than they can afford to lose in pursuit of bigger payouts.

Differences Between Forex Trading and Gambling

Despite the similarities, there are key differences that set forex trading apart from gambling:

1. **Market Analysis**: Successful forex traders rely on data analysis and market research. They study economic indicators, news reports, and chart patterns to inform their trading decisions. In contrast, many gambling games, especially those based on chance, do not allow for the same level of strategic thinking or analysis.

2. **Skill and Strategy**: Forex trading requires knowledge, skills, and experience to develop effective trading strategies. Traders must be aware of market trends, economic factors, and risk management principles. While gambling can involve strategy (e.g., poker), many games, especially those involving pure chance, do not reward skill to the same extent.

3. **Long-term Engagement**: Forex trading can be a long-term investment strategy, with traders participating actively in the market over extended periods. Many gamblers engage in short-term activities, such as playing a single hand of blackjack or a round of roulette. The approach and mindset can significantly differ between the two.

Responsible Trading and Gambling

Whether engaging in forex trading or gambling, responsible behavior is crucial. Understanding the risks involved and setting strict limits on losses can help prevent financial ruin. Here are some strategies for responsible trading and gambling:

1. **Educate Yourself**: Knowledge is your best asset. Take the time to learn the fundamentals of forex trading, market analysis, and risk management. Similarly, understanding the odds and mechanics of gambling games can improve your decision-making.

2. **Set Limits**: Establish clear limits for both trading and gambling. Determine how much capital you are willing to invest or wager and stick to that amount. Avoid chasing losses, which can lead to reckless behavior.

3. **Emotional Control**: Managing emotions is vital in both forex trading and gambling. Stay disciplined and avoid making impulsive decisions based on fear or excitement. Take breaks if you feel overwhelmed or emotionally charged.

Conclusion

In conclusion, while forex trading shares some characteristics with gambling, it is ultimately a distinct activity that relies on informed decision-making and analysis. Understanding the nuances between the two is essential for anyone considering a foray into the world of forex. By approaching forex trading with the right mindset, knowledge, and strategies, individuals can elevate their trading experience beyond mere gambling. Whether you choose to trade or play games of chance, remember that responsible engagement is key to ensuring a positive experience in both realms.

(65) 6793 7805

(65) 6793 7805