Кредитные карты

If you have family or friends in other parts of the world, or you work with non-U.S. business clients, you might find a multicurrency account more convenient than using wire transfer services https://xn—-8sbn6apldz.xn--p1ai/media/pgs/?kak-vyviesti-dien-ghi-s-koshiel-ka-ts-upis-v-fonbietie-poshaghovaia-instruktsiia_4.html. Bank wires can have steep fees and exchange rate markups, and delivery isn’t as fast as domestic wires.

If you live or have close connections outside the U.S., you might need a more global account for certain banking needs. That’s where a multicurrency account comes in. Here’s how it works and how to know if one’s right for you.

Trading 212 UK Ltd. is registered in England and Wales (Company number 8590005).Registered address: Aldermary House, 10-15 Queen Street, London, EC4N 1TX. Trading 212 UK Ltd. is authorised and regulated by the Financial Conduct Authority (Firm reference number 609146).

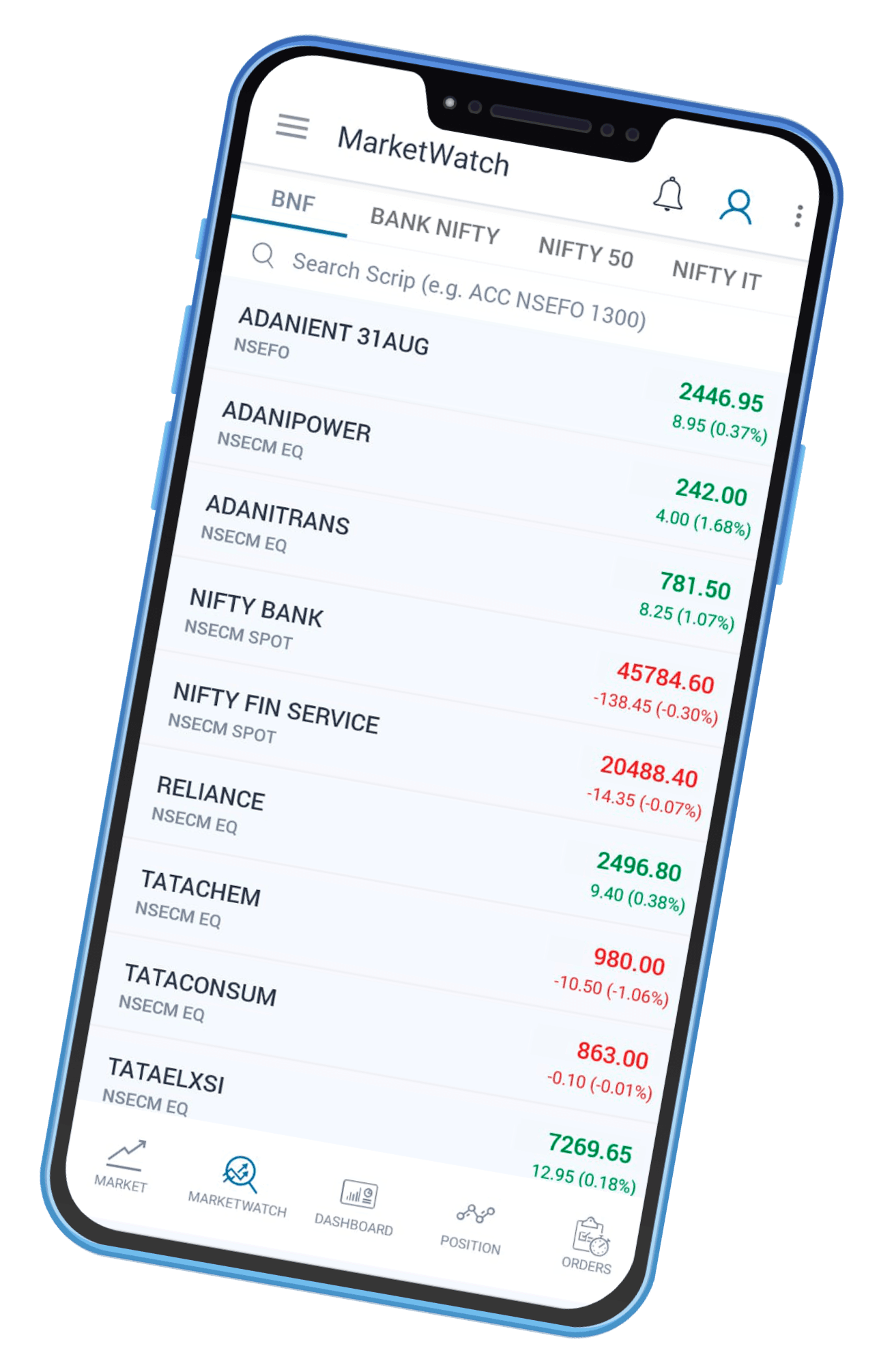

Mobile trading app

What’s missing: eToro’s mobile trading tools are built for accessibility, not complexity. Stock screening is limited, advanced charting is missing, and you can’t trade fixed income, mutual funds, or futures. U.S. investors also can’t designate a beneficiary, which could create complications down the line. And while options trading is available, the chain layout and analytics fall short for anyone running multi-leg strategies or assessing the Greeks in real time.

Do your best to understand how comfortable you are with risk and what levels of portfolio fluctuations you can stomach. Risk tolerance depends on factors such as your investment horizon and objectives, and personal financial situation. Your risk tolerance will determine the stocks you choose.

Jessica Inskip is Director of Investor Research at StockBrokers.com, bringing 15 years of experience in brokerage and trading strategy. A former FINRA-licensed rep, she held Series 7, 63, 66, and 4 licenses. Jessica focuses on investor education and brokerage industry research, appears regularly on CNBC, Bloomberg, The Schwab Network, Fox Business, and Yahoo! Finance, and hosts the Market MakeHer podcast.

After extensive testing and evaluation, I have determined the best stock trading apps for 2025. Among the top performers are Interactive Brokers, E*TRADE, Fidelity, Charles Schwab, and Merrill Edge. Each of these apps offers unique features and benefits tailored to different types of traders and investors.

Interactive Brokers (IBKR) has been a favored platform for professional traders for more than five decades. Best known for its flagship Trader Workstation (TWS) product, institutional investors choose IBKR for its sophisticated algorithms, order execution, and market data.

Commission-free profit withdrawal

Robinhood provides free stock, options, ETF and cryptocurrency trades (but no bonds or mutual funds), and its account minimum is $0, too. Robinhood Gold offers a high interest rate on uninvested cash and low margin rates.

If you’re just starting to invest, many top brokerages offer free stock-trading platforms that can get you started. They offer zero-commission trading and no account minimums, making investing affordable.

Robo-advisor: Schwab Intelligent Portfolios® and Schwab Intelligent Portfolios Premium™ IRA: Charles Schwab Traditional, Roth, Rollover, Inherited and Custodial IRAs; plus, a Personal Choice Retirement Account® (PCRA) Brokerage and trading: Schwab One® Brokerage Account, Brokerage Account + Specialized Platforms and Support for Trading, Schwab Global Account™, Schwab Organization Account and Schwab Trading Powered by Ameritrade™

RoboForex Ltd is a financial brokerage company regulated by the FSC, license No. 000138/32, reg. number 000001272. RoboForex Ltd is registered by the Financial Services Commission under the Securities Industry Act 2021. Address: 2118 Guava Street, Belama Phase 1, Belize City, Belize.

Vanguard is aimed at investors who want to hold funds long-term, so it doesn’t have many tools for active or short-term traders. It offers investment advice through the Vanguard Digital Advisor robo-advisor and Vanguard Personal Advisor Services.

This means that you trade your chosen financial instrument without getting hammered by brokerage fees. And of course, the best free trading platforms do not charge any fees to open an account, deposit funds, or keep your investments open.

(65) 6793 7805

(65) 6793 7805